Quiz – Woodmount Corporation Deferred Tax Liability Due to Excess Depreciation

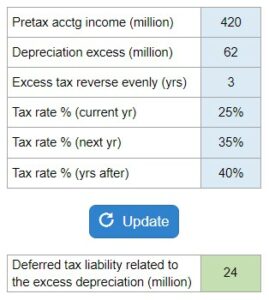

Determine the deferred tax liability related to the excess depreciation at the end of the current year.

Experts Have Solved This Problem

Please login or register to access this content.