Quiz – Value at Risk (VaR) of a Portfolio with Normally Distributed Returns

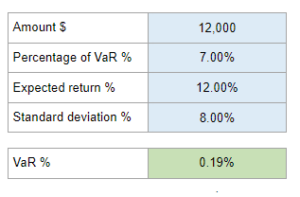

Calculate the Value at Risk (VaR) of a portfolio with normally distributed returns, using the given expected return and standard deviation, and determine the potential loss at a specific confidence level.

Experts Have Solved This Problem

Please login or register to access this content.