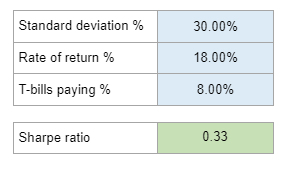

Quiz – Sharpe Ratio for a Portfolio with Given Returns and Volatility

Determine the Sharpe ratio for a portfolio that generated a certain return last year, with a specific standard deviation, and compare it to the return on T-bills. Make sure to consider the excess return over the T-bill rate in your calculation.

Experts Have Solved This Problem

Please login or register to access this content.