Quiz – See Shipping Deferred Income Tax Asset or Liability

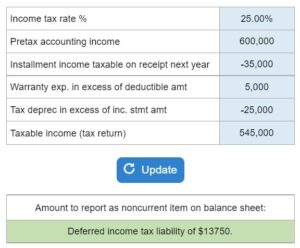

Determine the amount the company should report as a noncurrent item related to deferred income taxes in its balance sheet.

Experts Have Solved This Problem

Please login or register to access this content.