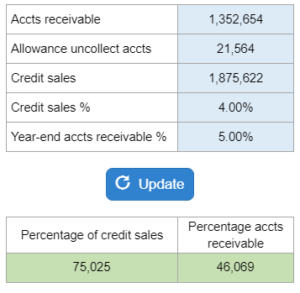

Given accounts receivable, allowance for uncollectible accounts, and credit sales, they ask you to determine the amount that should be charged to the bad debt expense under two methods.

Experts Have Solved This Problem

Please login or register to access this content.