Quiz – Occidental Petroleum Corporation

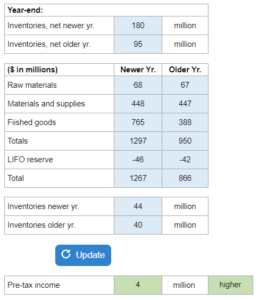

Given the inventories, raw materials, finished goods, and LIFO reserve, they ask you to determine how the pre-tax income would be affected had the company used FIFO to value the inventory.

Experts Have Solved This Problem

Please login or register to access this content.