Quiz – Madison Company Claims Tax Credit

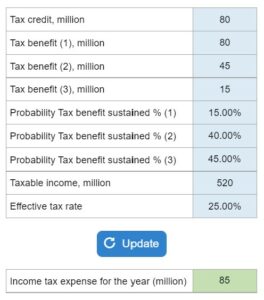

Given a tax credit, potential tax benefits, and their corresponding likelihood of occurrence, determine the income tax expense for the year.

Experts Have Solved This Problem

Please login or register to access this content.