Quiz – Kent Corp. Current Portion of Income Tax Expense, deferred tax liability, Income Tax Expense

This solver solves all three problems, but you will most likely only be asked for one of the green outputs.

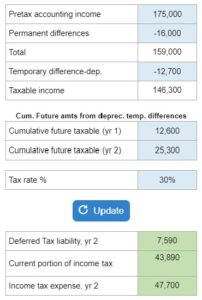

Given Pretax accounting income, permanent and temporary differences, and the cumulative future taxable amounts from depreciation temporary differences, determine the current portion of income tax, the deferred tax liability for the newer year, and the income tax expense for the newer year.

Experts Have Solved This Problem

Please login or register to access this content.