Quiz – Franklin Freightways Deferred Tax Liability or Asset

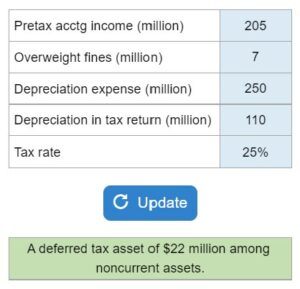

Given the firm's pretax accounting income, its overweight fines, and depreciation expense in both the income statement and tax return, determine if the firm has a deferred tax asset or deferred tax liability and whether it is a current or noncurrent item.

Experts Have Solved This Problem

Please login or register to access this content.