Quiz – Foxworthy Corporation

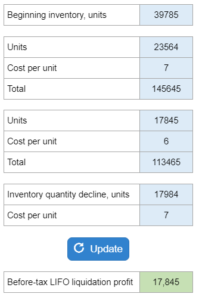

Given the beginning inventory, cost of purchased units, and inventory decline, they ask you to determine the pre-tax LIFO liquidation profit.

Experts Have Solved This Problem

Please login or register to access this content.