Quiz – Fieval Industries Deferred Tax Asset or Deferred Tax Liability

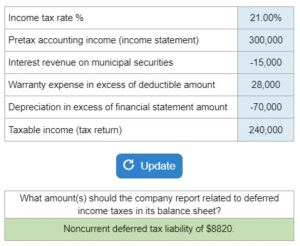

Determine the amount of the deferred income taxes that the company should report in its balance sheet.

Experts Have Solved This Problem

Please login or register to access this content.