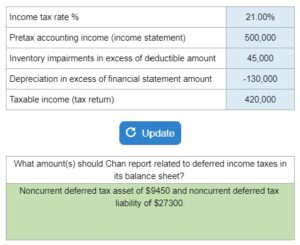

Quiz – Chan Inc. Deferred Tax Asset and Deferred Tax Liability

Determine the amount(s) the company should report related to deferred income taxes in its balance sheet. Chan Inc. pays taxes in Columbia and also in the U.S: Impairments relate to the Columbian tax return but Depreciation rules apply to the U.S. tax return.

Experts Have Solved This Problem

Please login or register to access this content.