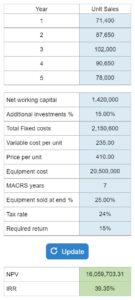

Problem 9.29 – Aria Acoustics, Inc. Calculating NPV and IRR for a New Product Launch

Given a large paragraph of information and 5 years' worth of sales, determine the NPV and IRR of the production of the implants. Calculate the NPV and IRR for a new product launch based on projected unit sales, fixed and variable costs, equipment costs, tax rate, and required return. Use the provided MACRS schedule and assume the equipment can be sold for % of its acquisition cost at the end.

Experts Have Solved This Problem

Please login or register to access this content.