Problem 9.23 and 9.24 – Machine Shop Production Efficiency Improvement Project

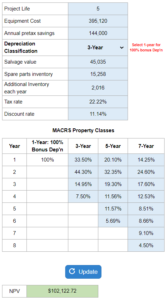

Calculate the project's NPV, considering the cost of the new machine press, annual pretax cost savings, depreciation, salvage value, initial and annual investments in spare parts inventory, tax rate, and discount rate.

Experts Have Solved This Problem

Please login or register to access this content.