Problem 9.19 – Brandtly Industries

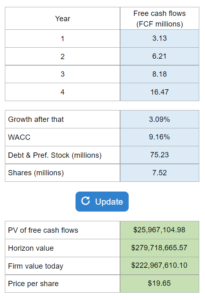

Given an estimate of free cash flows, growth rate, and WACC... determine the present value of the free cash flows for the explicit period, calculate the horizon value, and compute the price per share.

Experts Have Solved This Problem

Please login or register to access this content.