Problem 9.17 – Comparing Investment Criteria

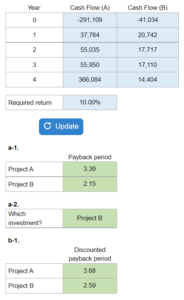

Given the cash flows and required return, figure out the payback period, discounted payback period, NPV, IRR, and profitability index. You then find which investment you'll choose for each and decide which investment to choose overall.

Experts Have Solved This Problem

Please login or register to access this content.