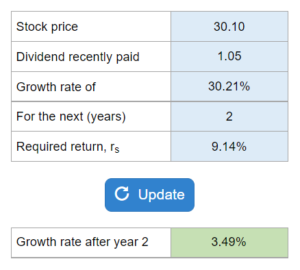

Problem 9.16 – Carnes Cosmetics Co.

Given the stock price, recently paid dividend, and expected dividend growth rate... at what constant rate is the stock expected to grow after a certain year?

Experts Have Solved This Problem

Please login or register to access this content.