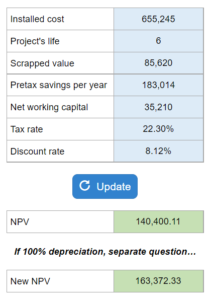

Problem 9.14 and 9.15 – NPV Calculation for Sausage System Investment Project

Calculate the net present value (NPV) of a project involving an investment in a sausage system, considering its initial installed cost, straight-line depreciation to zero over its life (OR 100% bonus depreciation), scrap value at the end of the project, annual savings in pretax operating costs, and initial investment in net working capital. Use the relevant tax rate and discount rate and determine the NPV for the sausage system.

Experts Have Solved This Problem

Please login or register to access this content.