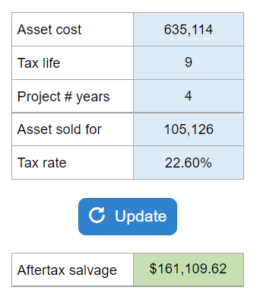

Problem 9.06 – After-Tax Cash Flow Calculation for Sale of Depreciated Asset

Calculate the after-tax cash flow from the sale of a depreciated asset that is used in a project lasting less than its full tax life, considering its initial cost, straight-line depreciation to zero over its tax life, and a projected sale price at the end of the project. Use the relevant tax rate and round your answer to the nearest whole number.

Experts Have Solved This Problem

Please login or register to access this content.