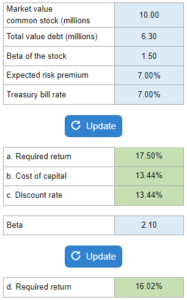

Problem 9-04, Okefenokee Real Estate Company

Given the market value of the common stock, total value of debt, the beta of the stock, the expected risk premium, and the treasury bill rate... determine the required return, cost of capital, the discount rate, and the required return given a new beta.

Experts Have Solved This Problem

Please login or register to access this content.