Problem 8.30 – Anderson International Limited, Foreign Investment Project with Blocked Cash Flows

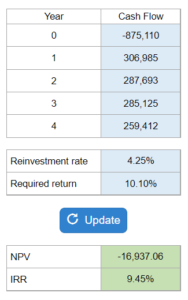

Evaluate a foreign investment project with cash flows in a foreign currency that are subject to reinvestment restrictions (block cash flows) imposed by the government. Calculate the net present value (NPV) of the project, assuming a required return and reinvestment rate, and round the answer to 2 decimal places. Additionally, calculate the internal rate of return (IRR) of the project.

Experts Have Solved This Problem

Please login or register to access this content.