Problem 8.28 – Cemetery Business Investment Analysis

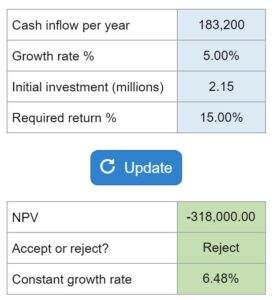

Calculate the net present value (NPV) of a cemetery business investment opportunity based on given cash flows and required return. Determine whether the investment should be accepted or rejected. Additionally, calculate the constant growth rate at which the cemetery business would break even.

Experts Have Solved This Problem

Please login or register to access this content.