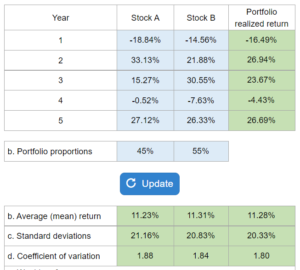

Problem 8.20 – Stocks A & B Historical Returns

Given a table with five years worth of historical returns... calculate the average (mean) return, standard deviation, and coefficient of variation of each stock as well as for a portfolio formed with stocks A and B.

Experts Have Solved This Problem

Please login or register to access this content.