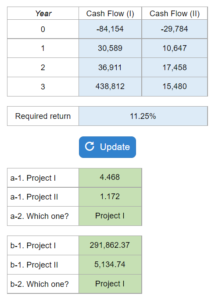

Problem 8.14 – Profitability Index Cash Flow (I) Cash Flow (II) Mutually Exclusive Design Projects

You are given three years' worth of cash flows for projects I and II and are asked to evaluate the two projects based on the profitability index for part a, and then to redo the problem based on the NPV criterion.

Experts Have Solved This Problem

Please login or register to access this content.