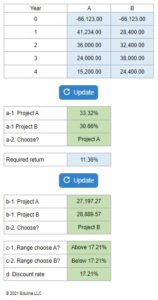

Problem 8.10 – Cash Flow (A) & Cash Flow (B), Two Mutually Exclusive Projects

Determine the IRR of projects A and B, then calculate the NPV of each project. Evaluate the range of discount rates whereby A is preferred and the range of discount rates whereby B is preferred. Finally, find the discount rate where you would be indifferent between the two projects.

Experts Have Solved This Problem

Please login or register to access this content.