Problem 8.06A – Texas Roadhouse Gift Cards

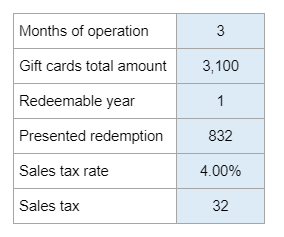

Given information regarding the selling of gift cards... record the sale along with determining the deferred revenue balance.

Experts Have Solved This Problem

Please login or register to access this content.