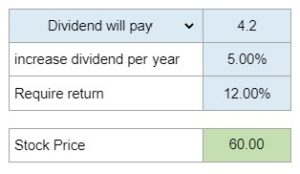

Problem 8.04 – Stock Valuation with Growing Dividends

Given a company's dividend per share for the next year, a constant annual dividend growth rate, and the required return on investment, calculate the current price an investor should pay for the company's stock.

Experts Have Solved This Problem

Please login or register to access this content.