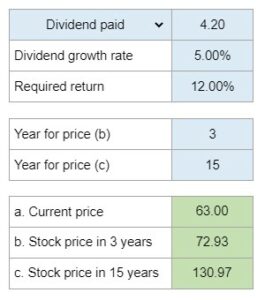

Problem 8.01 – Stock Valuation with Constant Dividend Growth

Given a company's recently paid dividend per share, a constant dividend growth rate, and the required return by investors, calculate the current price of the company's stock. Determine the stock price in a few years and in many years from now.

Experts Have Solved This Problem

Please login or register to access this content.