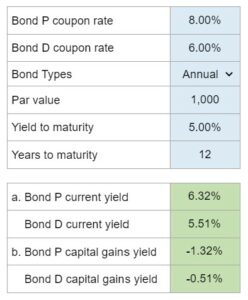

Problem 7.32 – Current Yield and Capital Gains Yields for Premium and Discount Bonds

Determine the current yield and expected capital gains yield over the next year for two bonds with given coupon rates, par values, yield to maturity, and years to maturity, while explaining the interrelationships among various types of yields.

Experts Have Solved This Problem

Please login or register to access this content.