Problem 7.30 – In practice, a common way to value a share of stock…

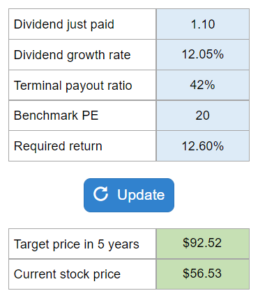

Determine the target price and the stock price today using the terminal stock price and benchmark PE ratio method. What is the target stock price in five years and the stock price today for a company that just paid a dividend of $1.41, with dividends expected to grow at 13 percent over the next five years and a payout ratio of 30 percent and a benchmark PE of 19 in five years, assuming a required return of 11 percent on the stock? (Your numbers will vary).

Experts Have Solved This Problem

Please login or register to access this content.