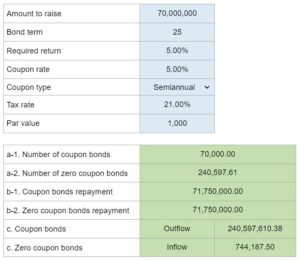

Problem 7.29 – Bond Issuance Comparison: Coupon Bonds vs. Zero-Coupon Bonds

Determine the number of coupon and zero-coupon bonds required to raise a specific amount, the repayment amount after 20 years for each bond type, and the after-tax cash flows for the first year, given the required return, coupon rate, tax rate, and par value.

Experts Have Solved This Problem

Please login or register to access this content.