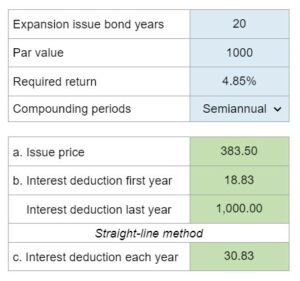

Problem 7.28 – Zero-Coupon Bond Issuance and Interest Deductions

Determine the issuance price, interest deductions using the IRS amortization rule and straight-line method for a zero-coupon bond issued by a corporation to finance its plant expansion, given the par value, required return, and compounding periods.

Experts Have Solved This Problem

Please login or register to access this content.