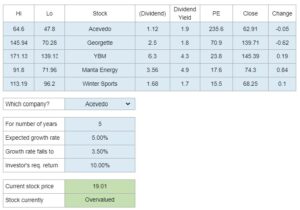

Problem 7.22 – Stock Valuation with Changing Dividend Growth Rates

Determine if a stock is priced correctly given the expected dividend growth rates for different time periods, the required rate of return, and other potential factors affecting the stock price.

Experts Have Solved This Problem

Please login or register to access this content.