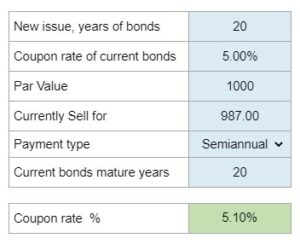

Problem 7.22 – Setting Coupon Rate for New Bonds to Sell at Par

Determine the coupon rate a company should set on its new bonds to sell at par, given the current bonds' coupon rate, selling price, payment frequency, par value, and time to maturity.

Experts Have Solved This Problem

Please login or register to access this content.