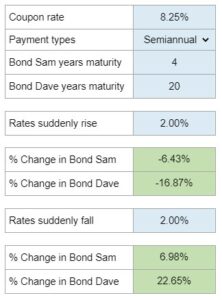

Problem 7.19 – Interest Rate Risk and Bond Price Changes for Different Maturities

Calculate the percentage change in the price of two bonds with the same coupon rate, payment frequency, and par value but different maturities, given a sudden increase or decrease in interest rates. Illustrate the results by graphing bond prices against YTM and discuss the interest rate risk of longer-term bonds.

Experts Have Solved This Problem

Please login or register to access this content.