Problem 7.18 – Bond Price Movements and Time to Maturity Relationship

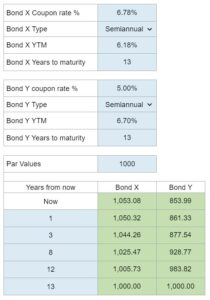

Determine the current price and future prices at various time points for two bonds with differing characteristics, given their coupon rates, YTMs, and time to maturity. Explain the observed pattern and graph bond prices against time to maturity.

Experts Have Solved This Problem

Please login or register to access this content.