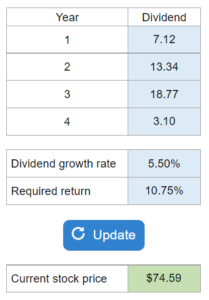

Problem 7.17 – Dividends Over the Next Four Years

A corporation is expected to pay a series of dividends over the next few years, and then maintain a constant growth rate in dividends in the future. If the required return on the stock is known, what is the current share price? Determine the share price given dividends for the next couple years and then a constant growth rate forever after that.

Experts Have Solved This Problem

Please login or register to access this content.