Problem 7.15 – Metallica Bearings Inc.

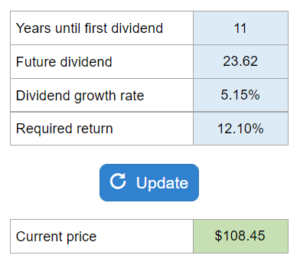

A young startup company, Metallica Bearings, Inc., will not pay dividends for the next nine years to fuel growth. In ten years, the company will pay a dividend of $14 per share and increase it by a constant rate. If the required return on the stock is 11.5 percent, what is the current share price? (Your numbers will vary). Determine the current share price for Metallica Bearings Inc given that it won't be paying dividends in the immediate future and then start paying dividends later on.

Experts Have Solved This Problem

Please login or register to access this content.