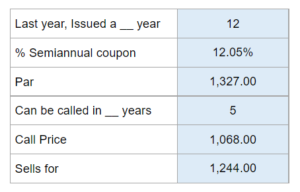

Problem 7.11 – Carson Industries

Given the information on the semiannual coupon bond, it's par value, call price, and selling price... determine the nominal yield to maturity, nominal yield to maturity, current yield, and expected capital gains yield for the coming year, and determine whether the bond is expected to be called.

Experts Have Solved This Problem

Please login or register to access this content.