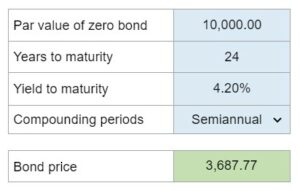

Problem 7.09 – Price of a Zero-Coupon Bond with Semiannual Compounding

You discover a zero-coupon bond that has a certain par value and a specific number of years until maturity. The yield to maturity on this bond is given as a percentage. Calculate the dollar price of the bond, assuming semiannual compounding periods.

Experts Have Solved This Problem

Please login or register to access this content.