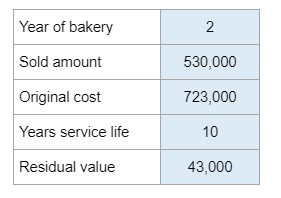

Problem 7.08A – New Morning Bakery

Given the amount ovens were sold for, the original cost, years of service life, and residual value... calculate accumulated depreciation, book value, gain or loss on the sale, and to record the sale.

Experts Have Solved This Problem

Please login or register to access this content.