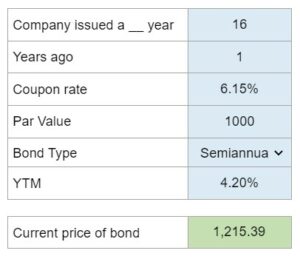

Problem 7.06 – Price of Semiannual Payment Bonds

Consider a company that issued bonds with a certain number of years to maturity a year ago at a coupon rate. The bonds make semiannual payments and have a par value. If the yield to maturity (YTM) on these bonds is a specific percentage, determine the current price of the bond in dollars.

Experts Have Solved This Problem

Please login or register to access this content.