Problem 7-05, Investors Bear Risk

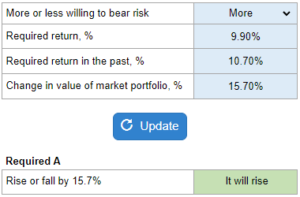

Given a scenario with required return now, required in the past, and a change in value in the market portfolio... determine if the stock prices will rise or fall by that amount.

Experts Have Solved This Problem

Please login or register to access this content.