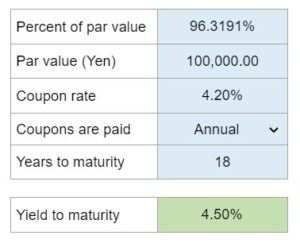

Problem 7.04 – Calculating the Yield to Maturity of a Japanese Bond

Consider a bond issued by a Japanese company that sells for a certain percentage of its par value. The bond has a coupon rate paid annually and matures in a specific number of years. Determine the yield to maturity of this bond.

Experts Have Solved This Problem

Please login or register to access this content.