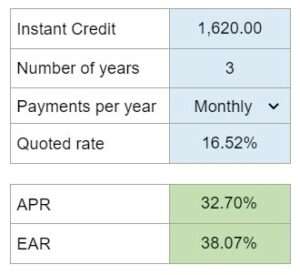

Problem 6.67 – Unveiling the True Cost of an Add-On Interest Rate Loan

Analyze a loan offer advertised with "instant credit," a simple interest rate, a repayment period, and "low, low monthly payments," illustrating a deceptive way of quoting interest rates called add-on interest. Calculate the annual percentage rate (APR) and effective annual rate (EAR) for this loan, considering the total amount owed after the repayment period and the equal monthly payments.

Experts Have Solved This Problem

Please login or register to access this content.