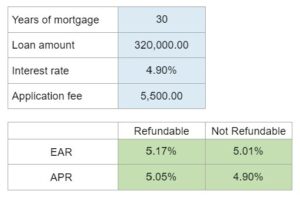

Problem 6.66 – EARs and APRs for Mortgages with Refundable and Nonrefundable Application Fees

calculate the effective annual rates (EARs) and annual percentage rates (APRs) for two 30-year mortgages with the same loan amount and interest rate from two different banks, both charging a loan application fee. One bank refunds the application fee if the loan application is denied, while the other does not. Consider the impact of the refundable and nonrefundable fees on the calculation of the APRs as per the current disclosure law. Find the APR and EAR on both loans.

Experts Have Solved This Problem

Please login or register to access this content.