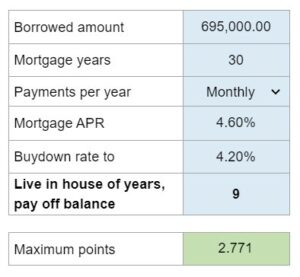

Problem 6.65 – Mortgage Points, Buy Down, Sell House Early

Determine the maximum number of points you would be willing to pay up front to buy down the interest rate on a 30-year fixed-rate mortgage with a specific loan amount and monthly payments, considering that you plan to live in the house for a certain number of years before selling it and paying off the remaining balance. Compare the mortgage options with their respective annual percentage rates, keeping in mind that a point on a loan is 1 percent of the loan value.

Experts Have Solved This Problem

Please login or register to access this content.