Problem 6.58 – Lease vs. Purchase: The Car Financing Decision

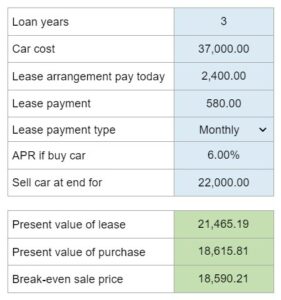

Determine whether it is more financially advantageous to lease or purchase a new car through a three-year loan, given the car's cost, special leasing arrangement with an initial payment and monthly payments, and the loan's annual percentage rate. Additionally, calculate the break-even resale price after three years that would make one indifferent between buying and leasing.

Experts Have Solved This Problem

Please login or register to access this content.