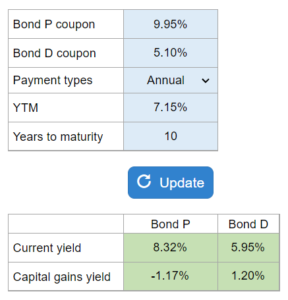

Problem 6.34 – Bond P and Bond D

What is the current yield for Bond P and Bond D, which are premium and discount bonds with different coupon rates, and what is the expected capital gains yield over the next year for both bonds if interest rates remain unchanged? Solve for the current yield and capital gains yield for Bond P and Bond D.

Experts Have Solved This Problem

Please login or register to access this content.