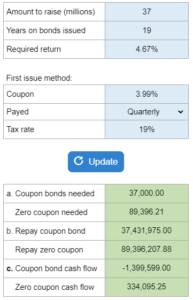

Problem 6.26 – Zero Coupon Bonds

What are the two alternative options for the company to raise money by issuing bonds, and what are the differences in terms of the number of bonds issued, years, and the firm's aftertax cash outflows for the first year under each scenario? Determine the number of coupon bonds and zeros that are needed, the company repayments, and the cash flows.

Experts Have Solved This Problem

Please login or register to access this content.